Free Excel Budget Template Easy to Use

Budgeting is an essential aspect of money management, whether it's for personal or business-related purposes. And when it comes to planning, aggregating, and analyzing budgets, Excel is still the go-to tool for many people from different lifestyles and professions.

Having a budget template in Excel is a more accessible, affordable, and familiar option for many users. What's more, you can easily customize your templates to suit your exact budgeting needs. Whether you need to budget for your new startup business, control annual department spending, or save up for your first car, there is a template out there for everyone.

So, if you're an Excel fan, here are some of our favorite free Excel budget templates that you can customize to fit your own needs:

Free Excel budget templates for 2022

- Expense tracker by Sheetgo

- Monthly Budget Planner by Money Under 30

- Annual Budget Planner by Budget Templates

- Student Budget template by Microsoft

- Household Expense Budget template by Smartsheet

- Zero-based Budget Spreadsheet by Smartsheet

- Money Manager template by Smartsheet

- Small business budget template by Capterra

- What are budget templates?

- Why use budget templates in Excel?

Free Excel budget templates for 2022

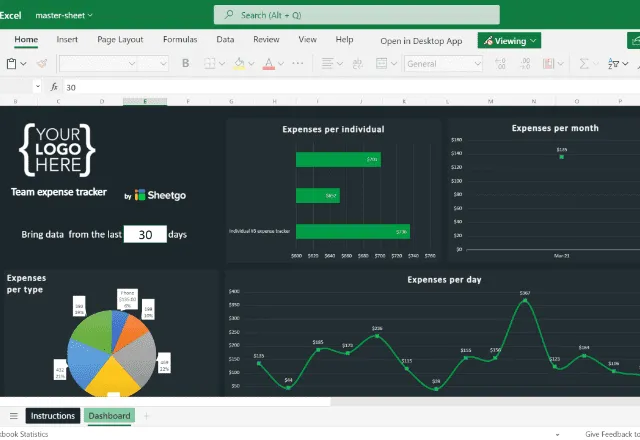

1. Expense tracker by Sheetgo

This Sheetgo Expense tracker template is ideal for small businesses and project teams — or anyone looking for a simple way to monitor expenses and automate financial management in their company. You could even use it at home with your family, to track how much each person is spending!

The Expense tracker workflow is not only easy to use, but it also gives you a better understanding of where your expenses come from. Share the individual expense tracker spreadsheets with each user so that they can track their spending. These individual sheets are then connected to the expenses master sheet, where all budgeting data is combined for an entire overview of group spending.

Add as many individual tracker spreadsheets as you need for your members. Make the most of the visual dashboards to receive actionable insights from your raw data to help make important future budgeting decisions.

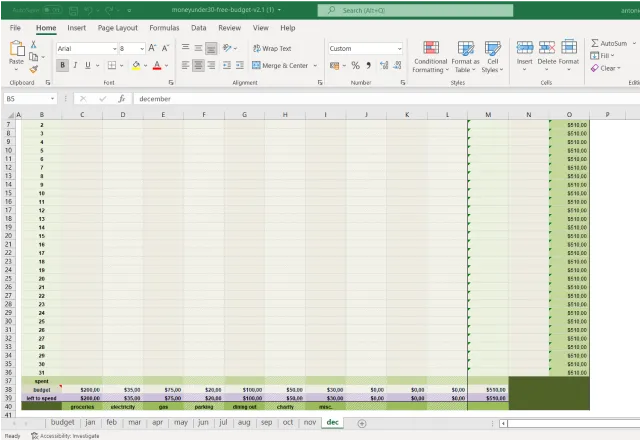

2. Monthly Budget Planner by Money Under 30

This budget planner by Money Under 30 takes monthly money management to a new level with a dedicated page for every month of the year. Each page is divided into sections that you can customize to the different areas of your spending. Simply input your purchases in the corresponding category, and you can easily track how much money you've spent in that month, and how much of your budget is left over.

And as if that's not enough to keep your finances in check, the template also has a summary page where you can find snapshots of your debts and savings.

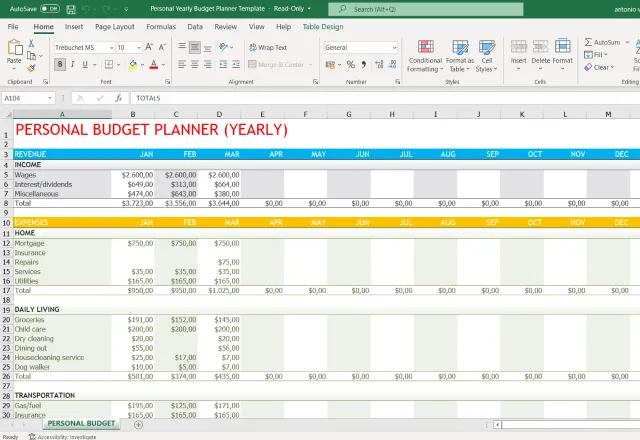

3. Annual Budget Planner by Budget Templates

Budget Templates offers a detailed yearly personal budget planner that gives you an overview of your yearly budget to help you keep your finances aligned. The spreadsheet can hold a year's worth of detailed budgeting information in just a single tab. Each worksheet has customizable sections where you can input additional income and investments, so you have everything in one place.

This is a great option for those who need an effective overview of their financial spending over multiple years. It could be a great option for regular, long-term spending such as mortgages, loans, and annual vacations.

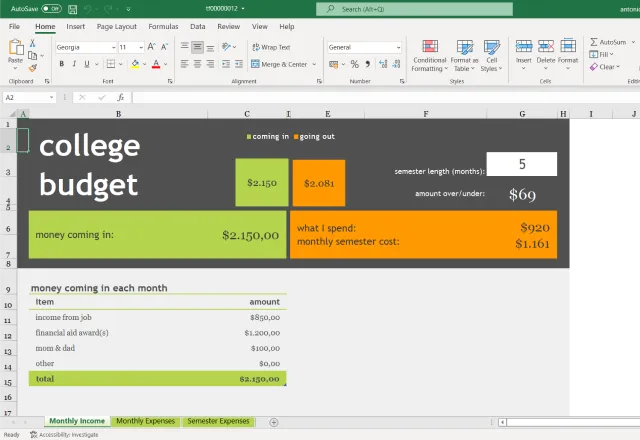

4. Student Budget template by Microsoft

Managing finances can be a challenge for students, especially for those who've just started college and are experiencing the huge responsibility of living on your own.

Microsoft's Student Budget template is the perfect budgeting tool for those who want to track and control their allowance and part-time job incomes. Add your college-related spending into one tab, and your personal spending in the other. The template will calculate the budget of your personal spending so you never have to worry about going over your income.

The best thing is that you can use this template both as a downloadable file, but also as an online version, so you can access it on any computer or mobile device.

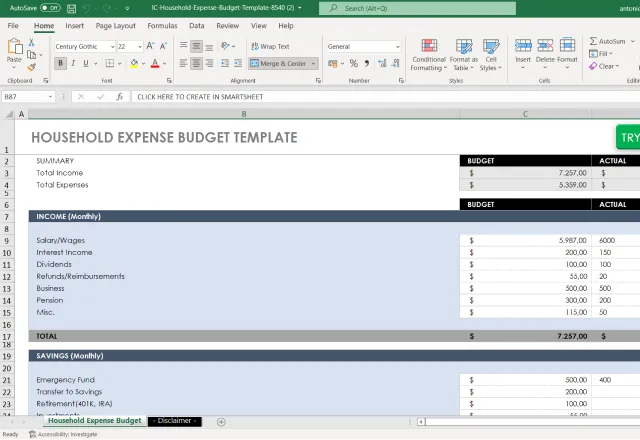

5. Household Expense Budget by Smartsheet

This financial management tool is made for budget-conscious families. With the Household Expense Budget planner by Smartsheet, you track the income and spending of your entire household.

Each sheet in the template is dedicated to a single month of the year, giving you a more detailed insight into your family's monthly cash flow. Track continuous outgoings such as the mortgage, utility bills, and internet. Then, track one-off expenses such as restaurant bills, cinema tickets, and airfare. With this template, you can even create an emergency fund budget and assign income to your savings account, for a more reliable and secure budgeting solution.

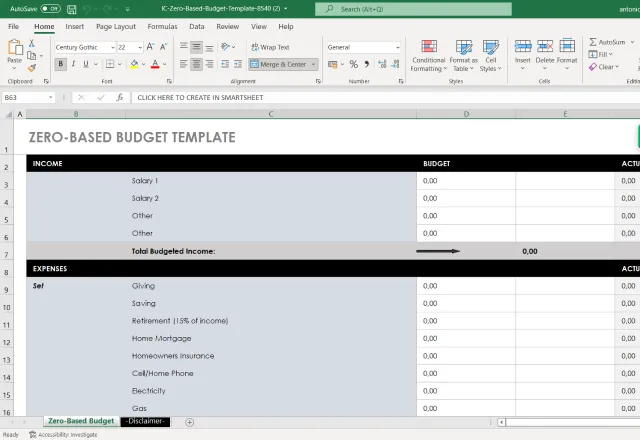

6. Zero-based Budget Spreadsheet by Smartsheet

The idea behind this Excel sheet budget template is to allocate every dollar of your income to a part or aspect of your budget, so the difference between both equals zero.

The Zero-based budget Spreadsheet has two sections – one side for your monthly income and another for your expenses. Once you finish filling out both areas, the difference should be zero. If not, you should adjust either side. This method allows you to track and easily trace where your money is going.

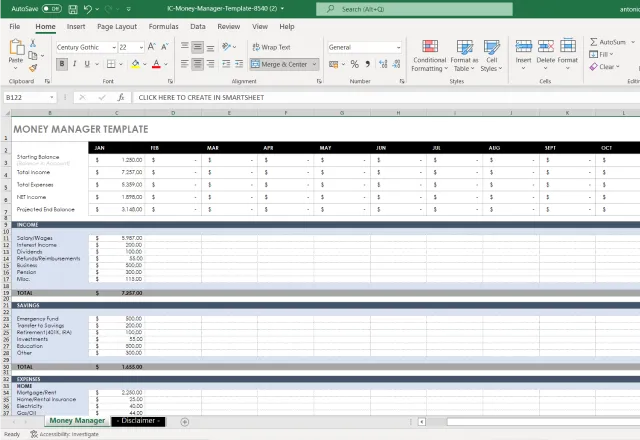

7. Money Manager template by Smartsheet

Looking for a budgeting tool that will let you manage your budget and keep an eye on your expenses in a single location?

If so, the Money Manager template is a great option to consider. It's an all-in-one budgeting solution that records and tracks all your financial transactions, and even balances your checkbook.

Get the template here: Money Manager template

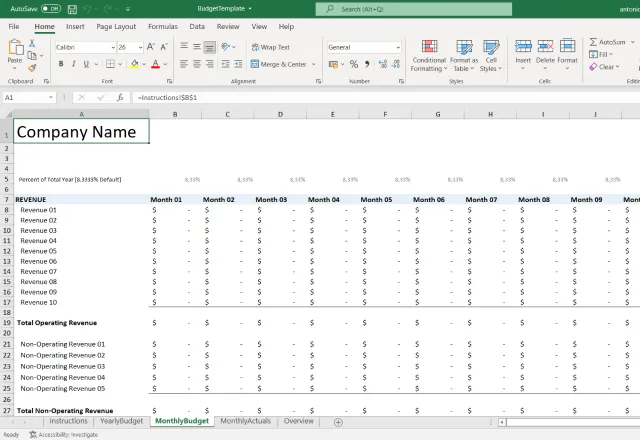

8 Small business budget template by Capterra

Starting to dabble in the world of business, the Small Business Budget template will be an interest to you.

Capterra has developed a versatile and user-friendly budgeting spreadsheet that startup owners can use for both long-term and short-term budget planning. The template also features an overview sheet. This sheet provides analytical insight into the efficiency of your business budgeting strategy.

Simply add your operational and non-operation income, then input your fixed and variable costs. This template will then calculate your gross profit, with an in-depth breakdown and analysis of where your money is going.

What are budget templates?

Budgeting templates are a pre-built structure you can use inside a spreadsheet to organize, manage and monitor your budgeting needs. They can save you a lot of time and manual effort by organizing and calculating your finances for you.

Although budgeting templates can differ with various features, the general idea is the same. Note down and keep track of all the various outgoing payments on a weekly, monthly or yearly basis. These templates will help you have a clear overview of how much you're spending and on what you're spending it on, as well as your total gross income.

You can use budgeting templates both in professional and personal circumstances. Here are just a few examples:

- Startup business annual budgeting

- Monthly department budgeting

- Student budgeting

- Family household budgeting

- Event budgeting

- Personal budgeting (to save for a vacation or new car)

Why use a budget template in Excel?

As the most widely used spreadsheet tool, Excel is a popular choice for data management. Using a budgeting template in an already familiar tool is perhaps the simplest option for keeping track of your finances.

Using a budgeting template inside Excel has a range of benefits, including:

- Accessibility: Almost everyone has access to Excel. What's more, you can open Excel online, so you can collaborate with other users or update your template from any device.

- Personalization: Adding your templates in Excel means that it's easy for you to customize the templates to your exact needs. You can add or remove various cells or columns, or tailor the content to your specific situation.

- Optimization: By having your budgeting template in Excel, you can access Microsoft's range of analytical features and functionalities. Create graphs and charts to visualize your data, or use different formulas to calculate new insights.

- Affordability: Spreadsheet templates are (for the most part) free, unlike complex finance software. Simply download your copy and get budgeting! No large upfront costs needed.

Free Excel budget templates

And there you have it! Excel is a versatile and valuable budgeting tool that has definitely proven its worth. But as with most things, there is no such thing as a one-size-fits-all money management tool. You'll need a specific template for a particular budgeting task.

There are a variety of budgeting templates available on the market, depending on your needs. Although all of the above templates are simple and easy to download for an immediate solution, the Sheetgo Expense tracker takes budgeting to the next level. Read our article to learn more about the Automated Expense tracker template in Excel.

Looking for more ways to control your finances? Go through all of our finance templates, both in Excel and Google Sheets, here.

Alternatively, check out some related blog posts below!

Editor's note: This is a revised version of a previous post that has been updated for accuracy and comprehensiveness.

barberprongling1995.blogspot.com

Source: https://blog.sheetgo.com/finance-processes/free-budget-templates-in-excel/

0 Response to "Free Excel Budget Template Easy to Use"

Post a Comment